Your Virtual Workforce

Banking Robotic Process Automation

RPA in Banking

Robotic Process Automation (RPA) is an essential ingredient in the Banking Industry today, and software robots are being deployed as the new virtual workforce to undertake repetitive and mundane jobs that humans would otherwise have to do.

What is RPA in Banking?

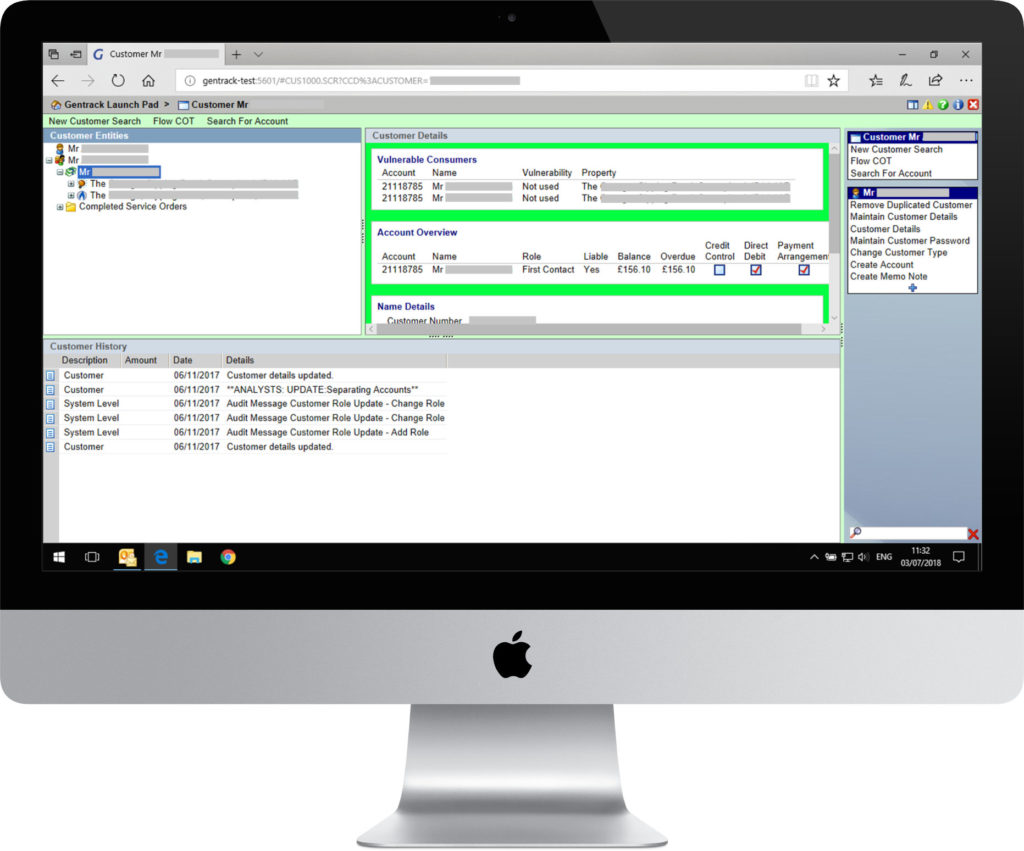

Automation of repeatable processes and data collection is the central area of focus for financial institutions where significant returns on investment are paramount. RPA bots, for example, can aid with the reviewing of business documents, facilitate the adding or removing of accounts across multiple new and legacy systems (GDPR etc.) and help eradicate human error.

The financial services industry are heavily investing in the virtual workforce, as bots are a way of speeding up deliverables to the end consumer, where accuracy and performance help the bottom line of any business. Robots do not sleep, and therefore, in a business environment where 24/7, 365 operability is paramount, bots are the go-to resource to increase customer service levels.

Manage

Costs

Business-led approach to the development of RPA reduces costs by facilitating early adoption of automation technology.

Reduce

Business Risk

Accounts & Invoices processed the same each time, therefore avoiding errors by successful repetition.

Regulate

Process

Audit of actions & steps in the executable process across disparate systems leads to traceability, transparency and accountability.

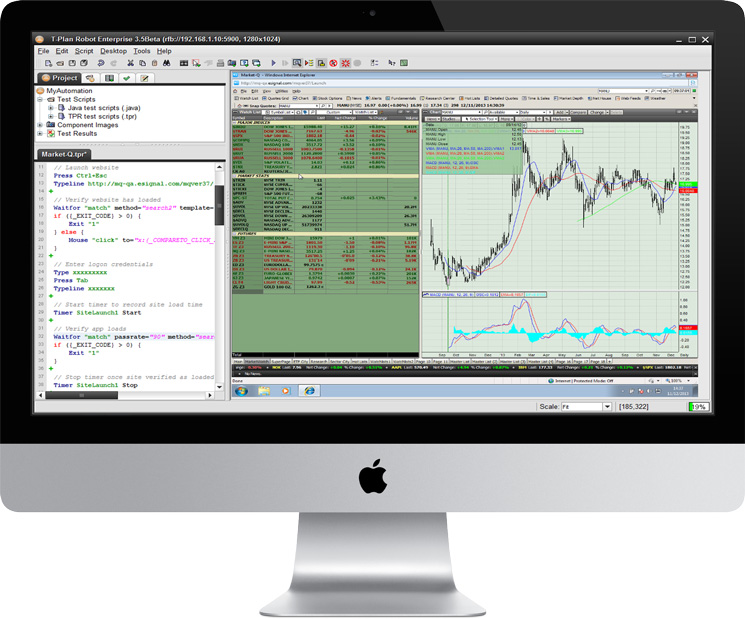

Automate “Closed” Applications

Many banking, financial and accounting software is closed source and impenetrable to traditional automation techniques or solutions.

However, as T-Plan Robot uses surface-based automation to control and drive the system as a user would do, we can automate anything!

Robotic automation has become an invaluable resource.